Automotive Insurance Quote: High-Risk Drivers in India & How to Navigate sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the factors that contribute to high-risk drivers in India, the challenges they face in obtaining insurance quotes, and strategies to navigate automotive insurance make this topic both informative and engaging.

Factors Contributing to High-Risk Drivers for Automotive Insurance

In India, several factors contribute to classifying drivers as high-risk individuals for automotive insurance. These factors play a crucial role in determining insurance premiums and coverage options.

Common Factors for High-Risk Classification

- Age: Young and elderly drivers are often considered high-risk due to lack of experience or physical limitations.

- Driving Record: Previous accidents, traffic violations, and DUIs can lead to high-risk classification.

- Vehicle Type: Sports cars or modified vehicles are often associated with higher risk due to increased speed and performance capabilities.

- Geographical Location: Drivers in high-traffic or accident-prone areas may be deemed high-risk.

Statistics on Road Accidents in India

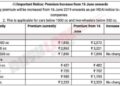

According to recent data, India has one of the highest rates of road accidents globally, with a significant portion involving high-risk drivers. In 2020, there were over 150,000 road fatalities reported in the country.

Impact of Driver Behavior on Insurance Premiums

Driver behavior, such as speeding, reckless driving, or distracted driving, can directly impact insurance premiums. High-risk behavior increases the likelihood of accidents, leading to higher premiums for drivers.

Examples of High-Risk Driver Categories in India

| Category | Description |

|---|---|

| Youthful Drivers | Drivers below the age of 25 with limited driving experience. |

| Repeat Offenders | Drivers with multiple traffic violations or accidents on record. |

| Commercial Drivers | Truck drivers or taxi drivers with long hours on the road, increasing fatigue and risk. |

Challenges Faced by High-Risk Drivers in Obtaining Insurance Quotes

High-risk drivers often face challenges when trying to obtain affordable insurance due to their increased likelihood of being involved in accidents or making claims. Insurance companies view them as higher risks and adjust their premiums accordingly.

Assessment of Risk Factors for High-Risk Drivers

Insurance companies assess risk factors for high-risk drivers by looking at various aspects such as age, driving experience, type of vehicle, location, and most importantly, the driver's past driving record. These factors help insurers determine the level of risk associated with insuring a particular driver.

- Age: Young drivers are considered high-risk due to their lack of experience, while older drivers may be considered high-risk if they have a history of accidents.

- Driving Record: A poor driving record with multiple accidents or traffic violations can significantly increase insurance premiums for high-risk drivers.

- Vehicle Type: Sports cars or high-performance vehicles are often associated with higher risks, leading to higher insurance rates.

Comparison of Obtaining Insurance Quotes for High-Risk and Low-Risk Drivers

The process of obtaining insurance quotes for high-risk drivers is more complex and costly compared to low-risk drivers. Insurance companies may require high-risk drivers to undergo additional assessments or pay higher premiums to offset the perceived risk.

- Low-Risk Drivers: Drivers with clean driving records and low-risk factors typically have access to more affordable insurance quotes with lower premiums.

- High-Risk Drivers: High-risk drivers may struggle to find insurance companies willing to cover them or may face significantly higher insurance rates due to their risk profile.

Role of Past Driving Records in Determining Insurance Premiums

Past driving records play a crucial role in determining insurance premiums for both high-risk and low-risk drivers. Insurance companies use this information to assess the likelihood of future claims and adjust premiums accordingly.

Drivers with a history of accidents or traffic violations are considered higher risks and may face higher insurance premiums.

On the other hand, drivers with clean driving records are perceived as lower risks and are typically offered more affordable insurance rates.

Strategies for High-Risk Drivers to Navigate Automotive Insurance

High-risk drivers face challenges when it comes to obtaining affordable automotive insurance. However, there are strategies they can implement to improve their insurability and lower their insurance premiums.

1. Driver Training Programs

Driver training programs can be beneficial for high-risk drivers as they provide valuable skills and knowledge to help improve driving behavior. Completing a defensive driving course or other certified training programs can showcase a commitment to safe driving, which insurance companies may view positively.

2. Improve Driving Record

One effective way for high-risk drivers to lower their insurance premiums is by improving their driving record. This can be achieved by avoiding traffic violations, accidents, and DUI convictions. Over time, a cleaner driving record can lead to reduced insurance rates.

3. Shop Around for Insurance Quotes

High-risk drivers should explore multiple insurance providers to compare quotes and find the best coverage options at competitive rates. Some companies specialize in providing insurance to high-risk drivers, so it's essential to research and find the right fit.

4. Consider Usage-Based Insurance

Usage-based insurance programs, such as telematics, track driving behavior through a device installed in the vehicle. High-risk drivers who demonstrate safe driving habits through these programs may be eligible for discounted premiums based on actual driving patterns.

Outcome Summary

In conclusion, understanding the nuances of automotive insurance for high-risk drivers in India is crucial. By implementing the strategies Artikeld and being aware of the challenges, drivers can navigate the insurance landscape more effectively.

Q&A

What factors contribute to classifying drivers as high-risk?

Common factors include age, driving history, type of vehicle driven, and location.

Why do high-risk drivers face challenges in obtaining affordable insurance?

Insurance companies perceive them as more likely to be involved in accidents, leading to higher premiums.

How can high-risk drivers lower their insurance premiums?

They can attend defensive driving courses, maintain a clean driving record, and compare quotes from multiple insurance companies.

What role do past driving records play in determining insurance premiums?

Past driving records heavily influence insurance premiums as they indicate the driver's risk level.

Are there alternative insurance options for drivers with a history of accidents?

Yes, some companies specialize in providing insurance for high-risk drivers, albeit at higher rates.